How Many Types of Options Are There?

Options can be classified according to the option rights.

Call options are financial contracts that give the holder the right—but not the obligation—to buy a stock, bond, commodity or other asset and instrument at a specified price within a specific time period.

Put options may be contrasted with call options. Put options give the holder the right—but not the obligation—to sell the underlying asset at a specified price within a specific time period.

Based on the previous classification, there are 4 basic trades.

1. Long Call

A trader who expects a stock's price to increase can buy a call option to purchase the stock at a fixed price ("strike price") at a later date, rather than purchase the stock outright.

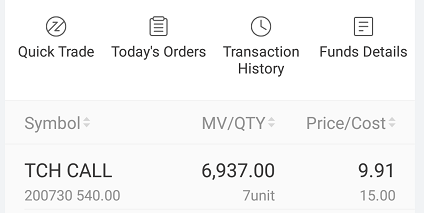

Example: A long call gives you the right to buy 700 shares of IBM at the price of $540/share before July 30, 2020.

1. Long Call

A trader who expects a stock's price to increase can buy a call option to purchase the stock at a fixed price ("strike price") at a later date, rather than purchase the stock outright.

Example: A long call gives you the right to buy 700 shares of IBM at the price of $540/share before July 30, 2020.

The cash outlay on the option is the premium. The trader would have no obligation to buy the stock but only has the right to do so at or before the expiration date. The risk of loss would be limited to the premium paid, unlike the possible loss had the stock been bought outright.

2. Long Put

A trader who expects a stock's price to decrease can buy a put option to sell the stock at a fixed price ("strike price") at a later date.

Example: A long put gives you the right to sell 700 shares of IBM at the price of $540/share before July 30, 2020.

* The interface is similar to Long Call shown above, same as Short Call and Short Put.

A trader who expects a stock's price to decrease can buy a put option to sell the stock at a fixed price ("strike price") at a later date.

Example: A long put gives you the right to sell 700 shares of IBM at the price of $540/share before July 30, 2020.

* The interface is similar to Long Call shown above, same as Short Call and Short Put.

The trader will be under no obligation to sell the stock but only has the right to do so at or before the expiration date. There will be 2 situations as follows:

1) If the stock price at expiration is below the exercise price by more than the premium paid, he will make a profit.

2) If the stock price at expiration is above the exercise price, he will let the put contract expire and only lose the premium paid.

1) If the stock price at expiration is below the exercise price by more than the premium paid, he will make a profit.

2) If the stock price at expiration is above the exercise price, he will let the put contract expire and only lose the premium paid.

It is important to note that one who exercises a put option, does not necessarily need to own the underlying asset. Specifically, one does not need to own the underlying stock to sell it. The reason for this is that one can short sell that underlying stock.

3. Short Call

A trader who expects a stock's price to decrease can sell the stock short or instead sell, or "write", a call. The trader selling a call has an obligation to sell the stock to the call buyer at a fixed price ("strike price"). If the seller does not own the stock when the option is exercised, he is obligated to purchase the stock from the market at the then market price.

Example: A short call means that you are obligated to sell 700 shares of IBM at $540/share before July 30, 2020.

There will be 2 situations as follows:

1) If the stock price decreases, the seller of the call (call writer) will make a profit in the amount of the premium.

2) If the stock price increases over the strike price by more than the amount of the premium, the seller will lose money, with the potential loss being unlimited.

A trader who expects a stock's price to decrease can sell the stock short or instead sell, or "write", a call. The trader selling a call has an obligation to sell the stock to the call buyer at a fixed price ("strike price"). If the seller does not own the stock when the option is exercised, he is obligated to purchase the stock from the market at the then market price.

Example: A short call means that you are obligated to sell 700 shares of IBM at $540/share before July 30, 2020.

There will be 2 situations as follows:

1) If the stock price decreases, the seller of the call (call writer) will make a profit in the amount of the premium.

2) If the stock price increases over the strike price by more than the amount of the premium, the seller will lose money, with the potential loss being unlimited.

4. Short Put

A trader who expects a stock's price to increase can buy the stock or instead sell, or "write", a put. The trader selling a put has an obligation to buy the stock from the put buyer at a fixed price ("strike price").

Example: A short put means that you are obligated to buy 700 shares of IBM at $540/share before July 30, 2020.

There will be 2 situations as follows:

1)If the stock price at expiration is above the strike price, the seller of the put (put writer) will make a profit in the amount of the premium.

2)If the stock price at expiration is below the strike price by more than the amount of the premium, the trader will lose money, with the potential loss being up to the strike price minus the premium.

A trader who expects a stock's price to increase can buy the stock or instead sell, or "write", a put. The trader selling a put has an obligation to buy the stock from the put buyer at a fixed price ("strike price").

Example: A short put means that you are obligated to buy 700 shares of IBM at $540/share before July 30, 2020.

There will be 2 situations as follows:

1)If the stock price at expiration is above the strike price, the seller of the put (put writer) will make a profit in the amount of the premium.

2)If the stock price at expiration is below the strike price by more than the amount of the premium, the trader will lose money, with the potential loss being up to the strike price minus the premium.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Dave1688 : Great

treydongui : Doing some extra credit for I'm returning for my late;)