Do You know the Four Profit & Loss Diagrams for Option Tradings?

Hi ~moomooers! ![]()

We have already introduced 4 basic trades of options before(click here —> How Many Types of Options are There?if you want to do a review). Today we will go deeper into their profit & loss disgrams. Hope you guys can know how to play with and profit from option after reading.

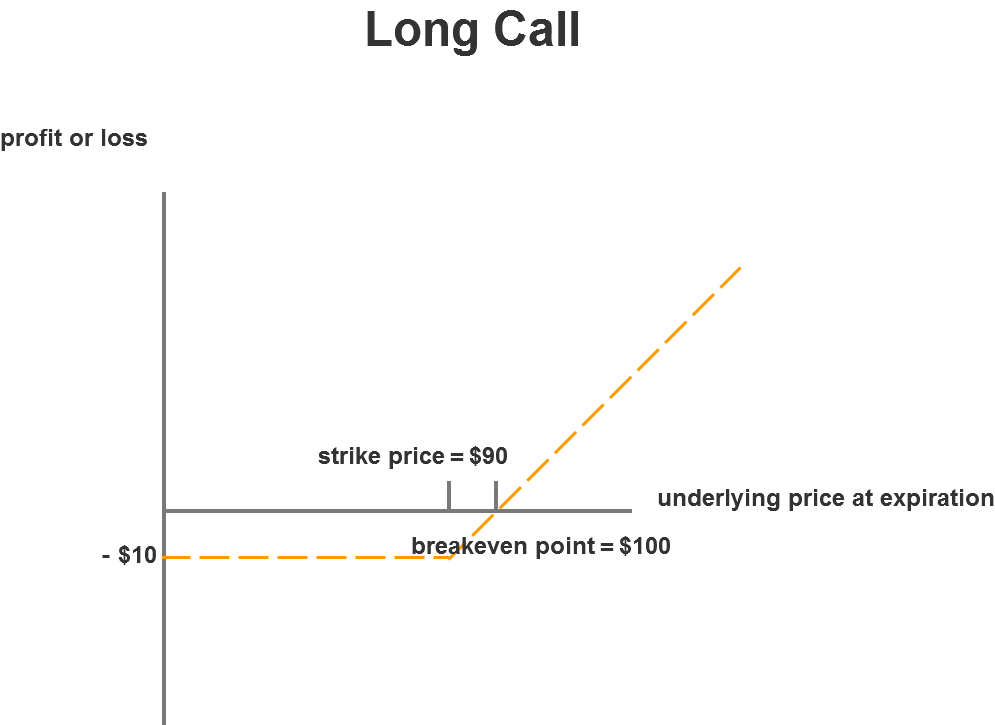

1. Long Call

First of all, we need to be clear that a stock option contract typically represents 100 shares of the underlying stock. The stock price displayed is the price of one share. When you choose to buy a unit of option, the price will be multiplied by 100 automatically.

Then suppose that a trader buys a call option at a market price of $10, and the strike price (also known as the exercise price) is $90. When the expiration date comes, there are several possibilities:

1) If the stock price is <$90, the trader will choose not to exercise his option. The maximum loss is the option premium paid. Noticed that a stock option contract represents 100 shares of stock, his profit

= - $10 * 100

= - $1,000 (the option premium paid)

2) If the stock price is $90 and if the trader chooses to exercise his option, after buying 100 shares at $90, his profit

= (stock market price - exercise price - option purchase price) * the number of shares

= (90 - 90 - 10) *100

= - $1,000 (the option premium paid);

if the trader chooses not to exercise his option, his profit

= - $1,000 (the option premium paid)

3) If $90< the stock price<$100, for example, when the price of the underlying object is $95, the trader chooses to exercise his option and his profit

= (stock market price - exercise price - option purchase price) * the number of shares

= (95 - 90 -10) *100

= - $500

4) If $100< the price of the underlying object, for example, when the price of the underlying object is $105, the trader chooses to exercise his option, and his profit

= (stock market price - exercise price - option purchase price) * the number of shares

= (105 - 90 -10) * 100

= $500

According to the derivation in the above example, you can plot the profit & loss curve of the call option on the expiration date, where the horizontal axis represents the price of the object at the time of expiration and the vertical axis represents profit & loss/100 shares:

We have already introduced 4 basic trades of options before(click here —> How Many Types of Options are There?if you want to do a review). Today we will go deeper into their profit & loss disgrams. Hope you guys can know how to play with and profit from option after reading.

1. Long Call

First of all, we need to be clear that a stock option contract typically represents 100 shares of the underlying stock. The stock price displayed is the price of one share. When you choose to buy a unit of option, the price will be multiplied by 100 automatically.

Then suppose that a trader buys a call option at a market price of $10, and the strike price (also known as the exercise price) is $90. When the expiration date comes, there are several possibilities:

1) If the stock price is <$90, the trader will choose not to exercise his option. The maximum loss is the option premium paid. Noticed that a stock option contract represents 100 shares of stock, his profit

= - $10 * 100

= - $1,000 (the option premium paid)

2) If the stock price is $90 and if the trader chooses to exercise his option, after buying 100 shares at $90, his profit

= (stock market price - exercise price - option purchase price) * the number of shares

= (90 - 90 - 10) *100

= - $1,000 (the option premium paid);

if the trader chooses not to exercise his option, his profit

= - $1,000 (the option premium paid)

3) If $90< the stock price<$100, for example, when the price of the underlying object is $95, the trader chooses to exercise his option and his profit

= (stock market price - exercise price - option purchase price) * the number of shares

= (95 - 90 -10) *100

= - $500

4) If $100< the price of the underlying object, for example, when the price of the underlying object is $105, the trader chooses to exercise his option, and his profit

= (stock market price - exercise price - option purchase price) * the number of shares

= (105 - 90 -10) * 100

= $500

According to the derivation in the above example, you can plot the profit & loss curve of the call option on the expiration date, where the horizontal axis represents the price of the object at the time of expiration and the vertical axis represents profit & loss/100 shares:

The profit of buying a call option = (stock market price - exercise price - option purchase price) * the number of shares.

Its maximum loss is the option premium paid.

2. Long Put

In the same way of plotting, you can draw the profit & loss diagram of the put option on the expiration date:

Its maximum loss is the option premium paid.

2. Long Put

In the same way of plotting, you can draw the profit & loss diagram of the put option on the expiration date:

The profit of buying put options = (exercise price - stock market price - option purchase price) * the number of shares.

Its maximum profit is the exercise price * the number of shares - option premium, and the maximum loss is the option premium paid.

3. Short Call

With the same plotting method, you can draw the profit & loss diagram of short-selling a call option on the expiration date:

Its maximum profit is the exercise price * the number of shares - option premium, and the maximum loss is the option premium paid.

3. Short Call

With the same plotting method, you can draw the profit & loss diagram of short-selling a call option on the expiration date:

Loss of short call options = (stock market price - exercise price - option purchase price) * the number of shares, the maximum loss may be infinite.

The maximum profit of short call options is the option premium earned.

4. Short Put

With the same plotting method, you can draw the profit & loss diagram of short-selling a put option on the expiration date:

The maximum profit of short call options is the option premium earned.

4. Short Put

With the same plotting method, you can draw the profit & loss diagram of short-selling a put option on the expiration date:

Loss of short put options = (exercise price - stock market price - option purchase price) * the number of shares.

The maximum profit of short put options is the option premium earned.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Dave1688 : Great