IPO-pedia | Footwear unicorn Allbirds is going to public, taking on lululemon

$Allbirds(BIRD.US$ , a sustainable footwear brand sold direct to consumer, announced terms for its IPO on Monday.

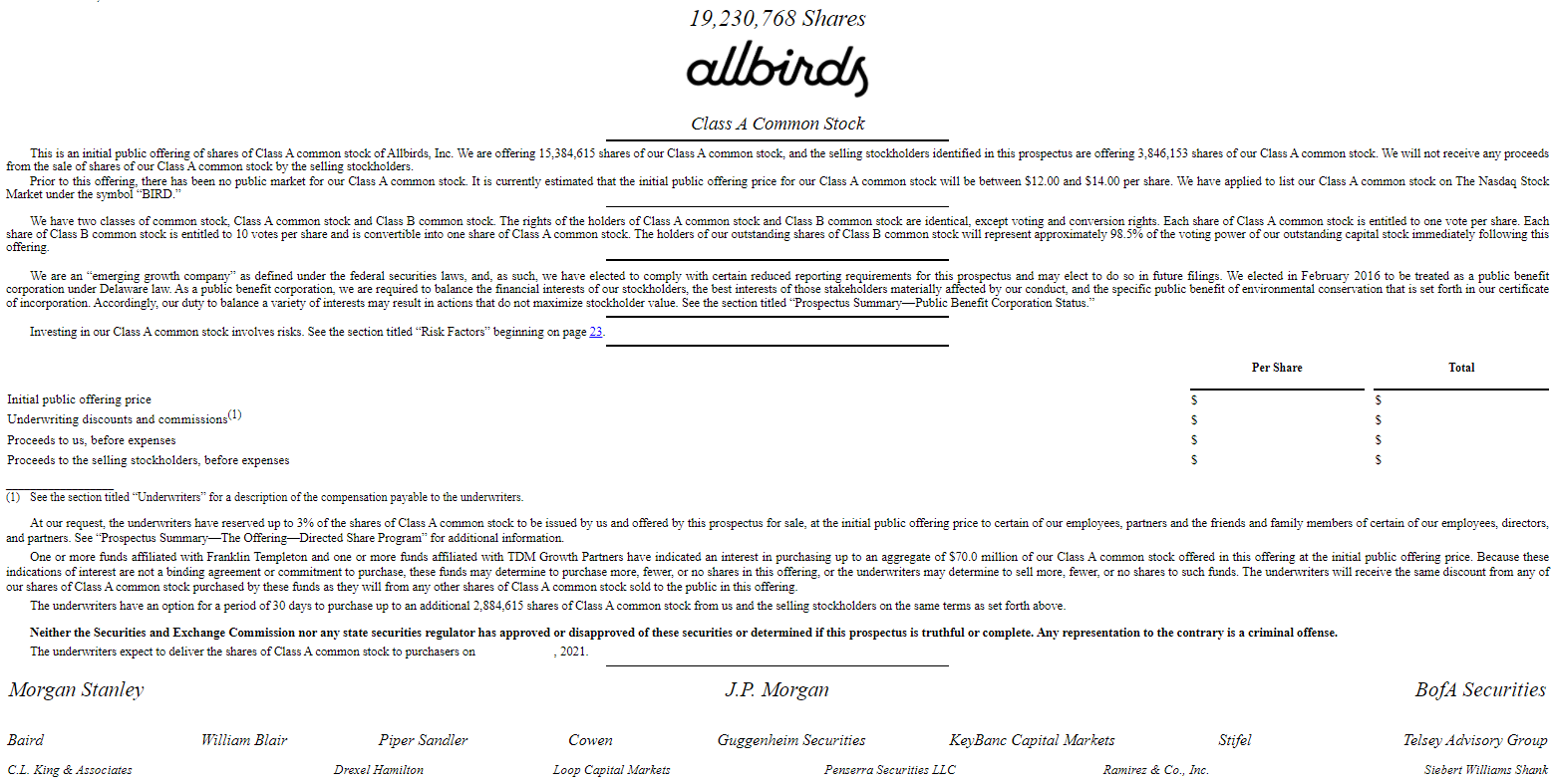

This company said it would offer 19.2 million shares, priced between $12 and $14. At the high end of that range, the IPO would earn Allbirds as much as $269 million.

Allbirds has yet to give a date for its IPO. The company is expected to list on the Nasdaq exchange under the ticker symbol BIRD. Morgan Stanley, J.P. Morgan and BofA Securitiesacted as joint bookrunners on the deal.

Existing shareholders Franklin Templeton and TDM Growth Partners intend to purchase $70 million worth of shares in the offering.

Allbirds, founded in 2015, is one of the growing number of direct-to-consumer (DTC) brands that hit unicorn status, with a $1 billion valuation in late 2018, just two years after its San Francisco launch. Franklin Templeton-backed Allbirds isvalues at $1.7 billion. Since its founding in 2015, Allbirds has become popular among Silicon Valley residents.

Its most iconic product, the Wool Runner, which TIME Magazine named the “World’s Most Comfortable Shoe,” features a distinctly simple design showcasing its sustainably-sourced merino wool combined with our innovative SweetFoam sole, made with the world’s first carbon-negative green ethylene-vinyl acetate, or EVA.

An average pair of Allbirds shoes carrying a carbon footprint that is approximately 30% less than our estimated carbon footprint for a standard pair of sneakers, due to the use of renewable, natural materials and responsible manufacturing.

The company has achieved its rapid growth through a digitally-led vertical retail distribution strategy. It markets directly to consumers via its localized multilingual digital platform and its physical footprint of 27 stores as of June 30, 2021.

In 2020, its digital channel represented 89% of the sales, while stores accounted for the other 11% of the sales. By serving consumers directly, it cuts out the layers of costs associated with traditional wholesalers, creating a more efficient cost structure and higher gross margin.

In its filing, Allbirds said that repeat customers accounted for 53% of its 2020 sales, up from 46% in 2019. The most active 25% of its U.S. customers won between 2016 and 2019 have spent $446 on Allbirds over the years.

The company achieved 13% year-over-year net revenue growth in 2020 to $219.3 million. It increased gross margin by 454 basis points from 46.9% in 2018 to 51.4% in 2020 due to favorable product and business mix.

Allbirds' revenue in the first half of 2021 rose 26.7% to $117.5 million. And the company's net loss more than doubled to $21.1 million.

Its Beneficial Owner includes Tiger Global, T. Rowe Price, Fidelity, Lerer Hippeau Ventures, etc.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

JJ003 : Feel like a worth-while company to invest to. My question is: How do we know about the company’s loss of 21 billions this year and Is the loss reasonable? How is the management team going to take actions to lessen the loss?

BTW, how can we trade on IPOs on MOO’s platform? The normal TRADE platform shows the name of the company only. Can any one help? Thank in advance.