Introduction to new advanced orders

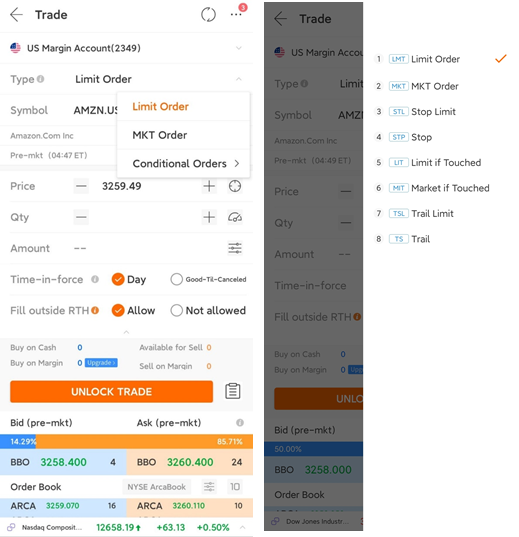

Hello, mooers! Have you guys noticed the latest updates of advanced conditional orders? In order to make trading more easily, we bring this new updates to you. This article is to show you what six new advanced orders are and how to use them.

Stop order:

A stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. It is typically used to limit a loss or help protect a profit on a short sale.

Example

Assume the current market price of a stock is 30:

● If you submit a buy stop order at 33, and later the market price rises to 33, the buy stop order will be triggered, become a market order, and begin to be filled at the closest price to 33 depending on volume at that price.

● If you submit a sell stop order at 26, and later the market price drops to 26, the sell stop order will be triggered, become a market order, and begin to be filled at the closest price to 26 depending on the volume at that price.

● If you submit a buy stop order at 33, and later the market price rises to 33, the buy stop order will be triggered, become a market order, and begin to be filled at the closest price to 33 depending on volume at that price.

● If you submit a sell stop order at 26, and later the market price drops to 26, the sell stop order will be triggered, become a market order, and begin to be filled at the closest price to 26 depending on the volume at that price.

Stop limit order:

A Stop Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated.

The order has two basic components: the stop trigger price and the limit price. When a trade has occurred at or through the stop trigger price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better.

Example

Assume the current market price of a stock is 30:

● If you submit a buy stop order at 33 and limit price at 35, and later the market price rises to 33, the buy limit order will be triggered and filled at a price no more than 35.

● If you submit a sell stop order at 26 and limit price at 25, and later the market price drops to 26, the sell limit order will be triggered and filled at a price no less than 25.

● If you submit a sell stop order at 26 and limit price at 25, and later the market price drops to 26, the sell limit order will be triggered and filled at a price no less than 25.

Limit if touched order:

A Limit if Touched(LIT) is an order to buy (or sell) an instrument at a specified price or better, below (or above) the market. This order is held in the system until the trigger price is touched.

Example

Assume the current market price of a stock is 30:

● If you submit a sell LIT order at 33 and limit price at 32, and later the market price rises to 33, the sell limit order will be triggered and filled at a price no less than 32.

● If you submit a buy LIT order at 26 and limit price at 27, and later the market price drops to 26, the buy limit order will be triggered and filled at a price no more than 27.

● If you submit a buy LIT order at 26 and limit price at 27, and later the market price drops to 26, the buy limit order will be triggered and filled at a price no more than 27.

Market if Touched Order:

A Market if Touched (MIT) is an order to buy (or sell) an instrument below (or above) the market. Its purpose is to take advantage of sudden or unexpected changes in share or other prices and provides investors with a trigger price to set an order in motion.

Example

Assume the current market price of a stock is 30:

● If you submit a sell MIT order at 33, and later the market price rises to 33, the sell MIT order will be triggered, become a market order, and begin to be filled at the closest price to 33 depending on volume at that price.

● If you submit a buy MIT order at 26, and later the market price drops to 26, the buy MIT order will be triggered, become a market order, and begin to be filled at the closest price to 26 depending on the volume at that price.

● If you submit a buy MIT order at 26, and later the market price drops to 26, the buy MIT order will be triggered, become a market order, and begin to be filled at the closest price to 26 depending on the volume at that price.

Trailing Stop Order

A sell trailing stop order sets the stop price at a fixed amount below the market price with an attached "trailing amount" or "trailing ratio". This order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain.

Example

Let’s assume that you purchase 100 shares of XYZ Company at 100 each. You put in a trailing stop order for 5%. If the shares drop 5% below market price, you would automatically sell the shares.

Although you have every expectation that XYZ Company’s stock will rise, if it does move against you, you’ll have limited your financial losses to 5% of the total investment. This protects you and locks in profit. If, however, the stock price rises, you will benefit from the gains.

Let’s say that XYZ Company’s stock jumps in a month to 200 per share. This order will only trigger if the price dips below 5% of 200 (190).

Trailing Stop Limit Order

A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. As the market price rises, both the stop price and the limit price rise by the trail amount and limit offset respectively, but if the stock price falls, the stop price remains unchanged, and when the stop price is hit a limit order is submitted at the last calculated limit price.

Example

Let’s assume that you purchase 100 shares of XYZ Company at 100 each. You put in a trailing stop limit. The investor sets a stop loss for 1 below the maximum price and a limit offset of 0.50 below the stop loss.

If the security is purchased at 100 per share, let’s assume it rises to 101 per share before dropping to 99 per share. This triggers the stop loss. Your broker now generates a limit order to sell the security. But unlike at trailing stop loss, there must be a buyer for the stock willing to purchase it at or above 98.50 (the 0.50 limit).

Below is the full introduction to new advanced orders, give it a try and leave comment, we appreciate any feedbacks and ideas you provide!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Mike-Fun enjoy : Can you introduce a trading where when a stock is bought immediately a one cancel other method go in . Example abc is trading at $10 you are planing to buy abc at 9.50. The moment the price drop to $9.50, you have a position and immediately a bracket order goes in. Setting a sell price say at 12 and a stop loss at $9.

102779576 : could you show the simplest way of setting a stop loss and target profit after a limit buy?

smartraider 102779576: Interested in this as well. Ibkr and other platform can do this as well

PandaMoo 102779576: Yes, an actual sample profitting from those new features will be clearer. The current explanation is too mouthful wordy

103891656 Mike-Fun enjoy: Hi Mike did you get an answer to your question, I also want this trading feature i.e. 1st triggers OCO(bracket), and I would want it to be easily modified as the trade progresses?